Create a budget is an great step in managing your finances effectively. Here are seven steps in creating a budget.

0 Comments

An index fund is a type of mutual fund or exchange-traded fund (ETF) that aims to get close to the same performance of a specific market index. Examples of a market index would be the S&P 500, the Dow Jones Industrial Average, or the Russell 2000. An index fund is not actively managed by a portfolio manager, such as an active mutual fund. An active mutual fund is just what is means, it’s actively managed by a fund manager. An index fund is passively invested in the same stocks and in the same proportion as the underlying index it tracks.

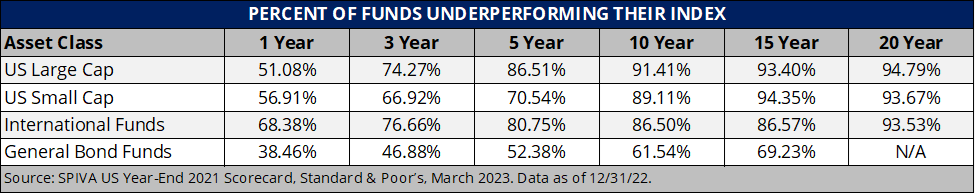

Index funds are popular among investors for several reasons: 1. Low Costs: Index funds are not actively managed, so the price to hold an index fund is normally cheaper than an actively managed fund. No fund manager has to do any research or analysis on which stocks to buy and sell. This is because an index fund does the exact same thing as the underline market index. These savings are passed onto the investor. 2. Diversification: An index is a great way to diversify your portfolio. Instead of buying one stock you buy for example the S&P 500. Now instead of owning one stock, you own all the stocks in the S&P 500 index. This is great news for new investors, because if a company goes bankrupt or does not do well for a few years it won’t bring down your whole portfolio. 3. Consistency: An index fund tends to have good long term track records with returns. Before you buy any stock or index fund, take a look at the long term returns. Make sure the index or stock you are buying has a good track record. You can do this with any brokerage house, just go to the index fund you want to buy and click on performance. You will be able to normally see returns from 1, 3, 5, and 10 years. 4. Performance: An index fund won’t outperform the market. If you buy the S&P 500, the index will try and match the returns of the underline index. While this is good because it should not underperform the market over time. The goal of any index fund is to match the returns of the underline index minus fees. Index funds are favored by investors who prefer a passive investment approach, instead of actively managed. This results in lower fees, and broad market exposure. They are often recommended for long-term investment strategies such as retirement planning.  Picture of five stacks of quarters. As you look left to right the stacks get bigger and bigger. Picture of five stacks of quarters. As you look left to right the stacks get bigger and bigger. It's never too late to start saving for retirement. It's time to take control of your financial future, regardless of age or current circumstances. Retirement planning is a process and it can take time. But no matter your age you can do it. It's true that when you start early you have time on your side but it's never too late to start. Anything saved for retirement is better than nothing. Just because you are starting late does not mean it's hopeless. Never think that. Here are a few steps for those who are starting to save for retirement later in life:

Tesla will report after the bell on 1-24-24. From what I've been reading, Tesla has had to cut prices in a few countries and EV sales are declining. Will be interesting to see if the cuts in prices are helping drive more sales.

2024 is right around the corner. It's the perfect time to start thinking about your investing goals for the year.

Step 1, pay off all debts. Start with the debts that have the biggest interest rates. Normally this is credit card debts. Step 2. Start an emergency fund. I recommend having 6 - 12 months of cash in an emergency fund. Step 3. Start investing every month into a good index fund. Step 4. Keep investing, even if stocks go down. When stocks go down it's the perfect time to keep invest. You will buy shares at a lower price. Start investing today, even if you don't have a lot to invest. If you only have $50 or $100 a month that's totally fine. Anything is better than nothing. A small amount today will grow every year. In 20 or 30 years you will have more than you thought you would.

TSLY is an ETF which buys options on Tesla. It's been returning 5% to 6% monthly. Does anyone own this ETF? What are your thoughts? Do you think it's a yield trap?

|

Tony Palermo

I've been investing for over 25 years. I trade stocks and love helping people understand finances. Archives

May 2024

Categories |

TONYPALERMOLIFECOACHING © 2022

RSS Feed

RSS Feed